June 2025 is shaping up to be a pivotal month for the crypto market, with $3.3 billion worth of tokens set to be unlocked as vesting periods for several major projects expire. This wave of token unlocks is significant, though it marks a 32% decrease compared to May’s $4.9 billion in releases.

Why Token Unlocks Matter

Token unlocks occur when previously locked tokens—often allocated to project teams, early investors, or community incentives—are released into circulation. These schedules are designed to prevent early holders from dumping large amounts of tokens before a project matures, but when unlocks happen, they can increase supply and potentially impact prices.

In June, the unlocks will be split between:

- Cliff unlocks: $1.4 billion released all at once.

- Linear unlocks: $1.9 billion released gradually over time.

Major Token Unlocks to Watch

Here are some of the biggest unlocks scheduled for June:

- Ripple (XRP):

- Unlock Date: June 1

- Amount: 1 billion XRP (about $2.3 billion)

- Notes: This is part of Ripple’s monthly escrow release, accounting for around 2% of the total supply. Historically, Ripple relocks 60–70% of the unlocked tokens, distributing only 30–40% for ecosystem needs, which helps limit the actual increase in circulating supply.

- Metars Genesis (MRS):

- Unlock Date: June 21

- Amount: $193 million

- Notes: This NFT project will use the unlocked tokens to fund an artificial intelligence partnership. MRS has already released nearly $1 billion in tokens since March.

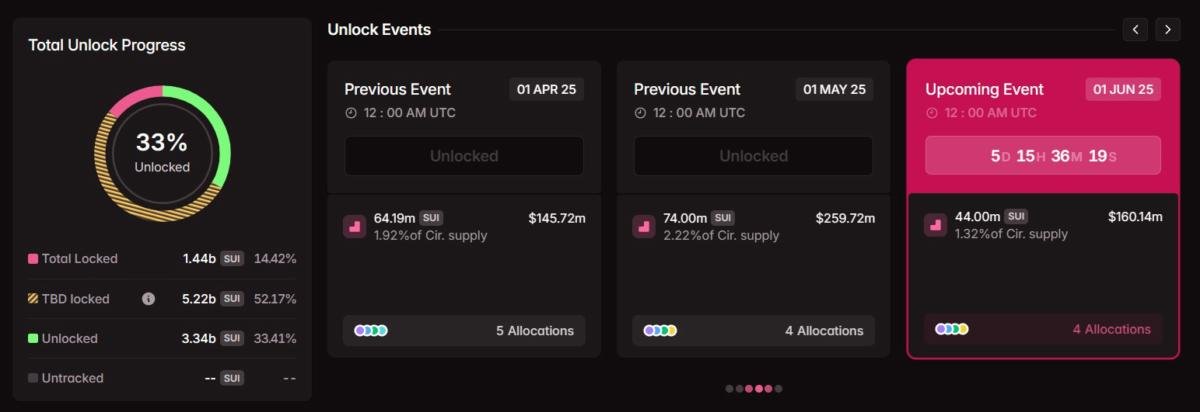

- Sui (SUI):

- Unlock Date: June 1

- Amount: 44 million SUI (about $160–$170 million)

- Notes: Tokens will go to the Mysten Labs treasury, early contributors, and the community reserve. This unlock represents about 1.3% of the total supply.

- Optimism (OP):

- Unlock Date: May 31

- Amount: 31.34 million OP (about $26–$30 million)

- Notes: This is about 1.8% of OP’s circulating supply. Previous unlocks have been absorbed by the market with minimal price impact, but short-term volatility is possible.

- Other Projects:

- Fasttoken (FTN): 20 million tokens ($88 million) to founders.

- LayerZero (ZRO): 25 million tokens ($71 million) to contributors and partners.

- Aptos (APT): 11.31 million tokens ($61 million) to contributors, foundation, and investors.

- ZKsync (ZK): Over 760 million tokens ($49 million) to investors and team.

What Could Happen to Prices?

Large token unlocks often raise concerns about downward price pressure due to increased supply. However, the actual impact depends on several factors:

- Market liquidity: Higher liquidity can absorb new supply more easily.

- Project practices: For example, Ripple’s habit of relocking a majority of XRP unlocks reduces the immediate impact on the market.

- Market sentiment: If the overall crypto market remains bullish, any price dips could be temporary.

Final Thoughts

While $3.3 billion in token unlocks is a headline-grabbing figure, not all of these tokens will necessarily hit exchanges or be sold immediately. Many projects have mechanisms in place to ease the impact, and much of the information is already priced in by savvy investors. Still, June will be a month to watch for anyone tracking crypto market dynamics.

How will the $3.3 billion token unlock in June impact crypto markets

The scheduled unlocking of $3.3 billion in crypto tokens in June 2025 is set to be one of the largest supply events of the year, and its impact on the market will depend on several key factors.

Potential for Short-Term Volatility

Large-scale token unlocks typically introduce a significant amount of new supply into the market. This can create downward pressure on prices, especially if a substantial portion of the unlocked tokens are sold immediately by recipients such as early investors, team members, or ecosystem partners. Historical trends show that sudden influxes of liquidity can lead to price dips, as the market absorbs the new tokens.

Market Sentiment and Project Fundamentals Matter

Not every token unlock leads to a price drop. The market’s reaction often hinges on the credibility of the project, current investor sentiment, and whether the unlock was anticipated and already priced in. For instance, some tokens have appreciated after major unlocks due to strong community support or bullish market conditions. If the overall crypto market remains in a bullish phase, as recent trends suggest, the impact of these unlocks may be muted or even positive for some projects.

Rotation and Capital Flows

Traders may rotate capital into tokens with lower inflation schedules or stronger fundamentals ahead of the unlocks, seeking to avoid assets facing immediate sell pressure. This capital rotation can temporarily depress prices of the unlocked tokens while benefiting others perceived as more stable or undervalued.

Liquidity and Absorption Capacity

The market’s ability to absorb the new supply is crucial. In periods of high liquidity and strong demand—such as during a bull run—the impact of token unlocks can be less severe, as buyers are willing to absorb the extra tokens. Conversely, in low-liquidity environments, the same unlocks can trigger sharper price corrections.

Project-Specific Unlock Mechanisms

Some projects, like Ripple (XRP), have mechanisms to relock a portion of the unlocked tokens or distribute them gradually, which can soften the immediate impact on the market. The design of the unlock schedule—whether tokens are released all at once (cliff unlock) or gradually (linear unlock)—also plays a role in determining market effects.

Summary Table: Key Factors Influencing Market Impact

| Factor | Potential Impact |

|---|---|

| Size and pace of unlock | Larger, sudden releases increase volatility |

| Market sentiment | Bullish sentiment can absorb supply more easily |

| Project credibility | Strong projects may see less negative impact |

| Liquidity | High liquidity dampens price drops |

| Unlock mechanism | Gradual or relocking schedules reduce shock |

| Trader behavior | Capital may rotate into lower-risk tokens |

Bottom Line:

While the $3.3 billion token unlock in June could spark short-term volatility and price pressure for certain assets, the overall impact will depend on broader market conditions, project fundamentals, and how well the market anticipates and absorbs the new supply. In a strong, bullish market with high liquidity, the effects may be limited or quickly reversed. However, traders should remain vigilant, as some tokens could face sharper corrections if the supply surge outpaces demand.