Introduction to Ola Electric

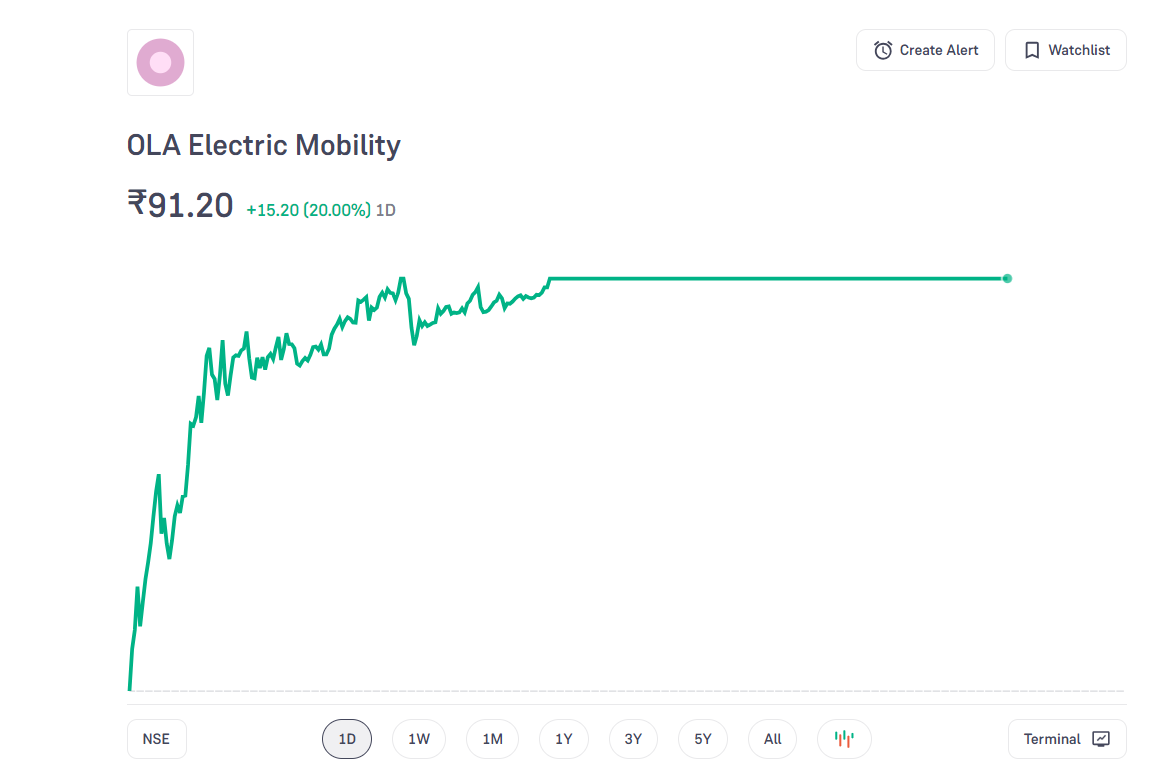

Ola Electric share price was growing rapidly for the last 4 days but today on the 5th day, Ola Electric share price has seen a huge decline. Today the share price of Ola Electric has fallen from Rs 119 to Rs 108.

Established in 2017, Ola Electric initially focused on creating an efficient charging infrastructure to support the widespread adoption of electric vehicles. Over the years, the firm’s scope has broadened, encompassing design, manufacturing, and distribution of its electric scooters and other innovative mobility solutions. The company’s product portfolio includes the much-anticipated Ola S1, a premium electric scooter known for its advanced features, exceptional range, and futuristic design.

The vision of Ola Electric is to create a cleaner and more sustainable future by transforming urban mobility. This vision is underpinned by cutting-edge research and development, a robust supply chain, and collaborations with global technology giants. The company’s commitment to innovation is evident in its state-of-the-art manufacturing facility, the Ola Futurefactory, which is touted as the world’s largest two-wheeler factory. This facility aims to produce 10 million electric scooters annually, reflecting the company’s ambitious growth trajectory.

Ola Electric’s entry into the electric vehicle market comes at a pivotal moment when the global automotive industry is experiencing a paradigm shift toward electrification. The company’s prominence in the market is further solidified by significant milestones, including securing substantial funding from prominent investors and forging strategic alliances. These achievements have not only enhanced its financial stability but also bolstered its competitive edge.

In summary, Ola Electric stands as a beacon of innovation and sustainability in the electric vehicle landscape. Its strategic initiatives and groundbreaking products continue to drive its ascent, making it a company to watch as the EV industry evolves. With a steadfast commitment to its mission and a clear vision for the future, Ola Electric is poised to lead the charge toward an electrified future.

IPO and Initial Share Price

Ola Electric’s Initial Public Offering (IPO) was a significant event in the financial markets, marking a major milestone for the electric vehicle manufacturer. The IPO was launched on 9 august 2024, with shares initially offered at a price of 76 rupees. This pricing positioned Ola Electric as a noteworthy entrant in the green energy sector, attracting substantial attention from investors and industry observers alike.

The anticipation surrounding Ola Electric’s entry into the stock market was palpable, driven by the company’s innovative approach to sustainable transportation and its strong market presence in India’s burgeoning electric vehicle sector. Investor confidence in the company’s future prospects.

Early trading sessions post-IPO saw the share price exhibit remarkable volatility. Various factors contributed to this movement, including market sentiment, analyst evaluations, and broader economic indicators. Notable events that influenced the initial share price included the announcement of strategic partnerships, product launches, and insights into future growth plans, all of which played a crucial role in shaping investor perceptions.

The initial performance of Ola Electric’s shares set the stage for its journey in the public market, establishing a foundation that has continued to influence investor sentiment and share price trends. As Ola Electric advances its mission to revolutionize the transportation landscape, its IPO remains a pivotal chapter in its corporate history.

Financial Performance

Ola Electric’s financial performance plays a pivotal role in determining its share price, making it essential to closely analyze their financial statements and key performance indicators. The company’s revenue trends indicate robust growth, reflecting an increased market demand for electric vehicles. Observing the quarterly and annual financial reports, we can see consistent revenue growth driven by strategic market expansion and innovative product lines.

One noteworthy metric is Ola Electric share price profit margins, which have displayed gradual improvement over recent periods. This enhancement can be attributed to operational efficiencies and reduced production costs, coupled with economies of scale as the company scales its operations. These factors collectively bolster investor confidence, thereby positively influencing the share price.

Further, examining market share growth provides additional insight into Ola Electric’s competitive positioning. Historical data reveals that Ola Electric has steadily grown its market share, outpacing several key competitors in the highly competitive electric vehicle sector. This growth is evidenced by increased sales volumes and market penetration, signaling a healthy trajectory toward market dominance.

Revenue streams for Ola Electric are diversified, encompassing vehicle sales, battery technology, and ancillary services related to electric mobility. This diversification not only supports revenue stability but also provides multiple avenues for future growth. Major expense areas include research and development (R&D) and marketing expenditures. Heavy investment in R&D enables Ola Electric to continuously innovate, offering cutting-edge products that meet consumer expectations. Marketing expenditures, meanwhile, help to build brand awareness and drive consumer acquisition.

When comparing these financial metrics with those of competitors, Ola Electric often showcases superior performance in revenue growth and market share expansion, key indicators of its potential to maintain a strong share price. Evaluating these financial facets provides a clear picture of Ola Electric’s current standing and its prospects for continued financial health and market relevance.

Ola Electric share price Market Position and Competitive Landscape

Ola Electric has emerged as a formidable player within the rapidly evolving electric vehicle market. Analyzing its market position reveals a strategic advancement mirrored by its significant market share. Comparatively, Ola Electric holds a notable presence in the industry despite stiff competition from established players like Tesla, Tata Motors, and Ather Energy. The unique value proposition of Ola Electric stems primarily from its innovative technology, competitive pricing, and robust customer service.

Technologically, Ola Electric has demonstrated a commitment to integrating cutting-edge advancements into its product line. Their scooters boast features such as advanced battery management systems, superior vehicle range, and smart connectivity options. These technical attributes not only enhance usability but also position Ola Electric at a vantage point within the highly competitive electric vehicle market.

When it comes to pricing, Ola Electric adopts a competitive strategy that seeks to make electric vehicles more accessible to a broader consumer base. Aggressive pricing, combined with government subsidies and incentives, has made Ola’s offerings financially appealing. This approach contrasts with some competitors who may focus more on the premium market segment, thereby enabling Ola Electric to capture significant market share among price-sensitive consumers.

Customer service is another area where Ola Electric sets itself apart. The company offers comprehensive after-sales service, including prompt and efficient maintenance support. Additionally, Ola has invested in establishing a wide network of charging stations, further alleviating concerns around the vehicle’s operational longevity and lifecycle management.

Strategic partnerships and acquisitions have also played a pivotal role in cementing Ola Electric’s market position. Collaborations with tech firms for advanced battery technology, and mergers with local manufacturers for scale production, have augmented their competitive edge. Such strategic maneuvers have not only strengthened Ola Electric’s market presence but also propelled its growth trajectory, making it a significant contender in the electric vehicle market.

Innovations and Technological Advancements

Ola Electric has distinguished itself in the burgeoning electric vehicle market through a series of groundbreaking innovations and technological advancements. The company has consistently made substantial investments in research and development (R&D), driving forward new product launches and securing important patents. These steps underscore Ola Electric’s commitment to staying at the cutting edge of EV technology.

One of the key technological advancements that set Ola Electric apart is its proprietary battery technology. By focusing on battery efficiency and longevity, the company has developed a battery architecture that not only enhances the range of its electric vehicles but also optimizes charging times. This battery technology represents a critical component in improving user experience and could lead to significant reductions in operational costs over time.

Furthermore, Ola Electric’s R&D efforts have led to advancements in autonomous driving features and smart connectivity. The integration of AI-powered systems for navigation and vehicle control offers potential enhancements in safety and user convenience. The seamless connectivity between the vehicle and user devices allows for intelligent monitoring and predictive maintenance, ensuring a smoother ride and prolonged vehicle life.

In addition to these technological strides, Ola Electric has actively sought to expand its product lineup. Recent product launches include several new models tailored to different consumer segments, from budget-friendly options to premium electric motorcycles. Each model incorporates advanced features like regenerative braking, digital dashboards, and customizable riding modes, appealing to a broad spectrum of potential buyers.

The cumulative effect of these innovations is likely to have a positive impact on Ola Electric’s share price. As the company continues to push the envelope in EV technology, it positions itself well for long-term growth. The anticipation of further advancements and the consistent improvement of their product offerings could attract more investors, driving up market confidence and, consequently, the share price in the foreseeable future.

Ola Electric Government Policies and Incentives

Government policies and incentives play a critical role in shaping the financial landscape of companies involved in the electric vehicle (EV) sector, including Ola Electric. These policies encompass a variety of supportive measures such as subsidies, tax breaks, and grants aimed at promoting the adoption and development of electric vehicles. The Indian government, in particular, has been proactive in implementing initiatives that benefit the EV industry, which in turn have implications for Ola Electric’s share price.

One of the key policies is the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme. FAME provides substantial subsidies on electric vehicles, thus lowering the purchase cost for consumers and incentivizing higher sales volumes. Ola Electric stands to benefit significantly from this scheme, as increased sales directly contribute to improved revenue streams, thereby positively influencing its share price. Additionally, the government’s broader vision under the National Electric Mobility Mission Plan (NEMMP) aims to attract investments in EV infrastructure, further reinforcing the market’s confidence in Ola Electric.

Tax incentives are another crucial aspect. The Goods and Services Tax (GST) on electric vehicles has been reduced from 12% to 5%, which is substantially lower than that on conventional vehicles. This reduction not only boosts consumer demand but also enhances the profit margins for manufacturers like Ola Electric. Enhanced profitability and higher market penetration are factors closely watched by investors, thereby impacting the market valuation of Ola Electric.

Moreover, the government also provides incentives related to research and development, which have facilitated advancements in battery technology and other critical components. These innovations are essential for improving the efficiency and cost-effectiveness of electric vehicles, rendering companies like Ola Electric more competitive. Consequently, market analysts may interpret such advancements as positive indicators for the company’s future performance, positively reflecting in its share price.

In summary, government policies and incentives create a supportive ecosystem that significantly influences Ola Electric’s financial performance and market valuation. By making electric vehicles more accessible and cost-effective, these measures boost consumer adoption rates, enhance profit margins, and stabilize investor trust—factors that are integral to the dynamics of Ola Electric’s share price.

Future Projections and Analyst Opinions

The future of Ola Electric’s share price trajectory appears to be promising yet complex, shaped by a multitude of factors. Leading market analysts and financial experts weigh in on the outlook, providing a range of projections and expectations. As the global shift toward sustainable mobility deepens, Ola Electric is poised to benefit significantly. The consensus among analysts suggests that the company’s focus on innovation and expanding its electric vehicle (EV) offerings will likely drive share price appreciation over the coming years.

One of the key opportunities for Ola Electric is its aggressive expansion plan, including the launch of new EV models and the establishment of a robust charging infrastructure. These initiatives are expected to enhance market penetration and attract a wider customer base, subsequently boosting the company’s valuation. Analysts from leading financial institutions forecast that if Ola Electric successfully executes its strategic plans, the share price could experience significant upward momentum.

However, potential challenges cannot be overlooked. The EV market is highly competitive, with numerous players vying for market share. Ola Electric faces competition from global giants like Tesla and emerging startups that are rapidly innovating. Additionally, supply chain disruptions and fluctuating raw material prices could pose hurdles. Experts caution that while the long-term outlook remains positive, short-term volatility may be inevitable.

Several financial experts point to upcoming projects that could substantially influence investor sentiment. Ola Electric’s ambitious plan to build one of the world’s largest EV manufacturing plants is a significant development. If successful, this project could position the company as a leading player in the EV market and potentially drive its share price higher. Analysts also emphasize the importance of government policies and incentives for EVs, which could either bolster or hinder growth depending on their direction.

Overall, while the road ahead may have its bumps, the future of Ola Electric holds considerable promise. By navigating challenges and capitalizing on strategic opportunities, the company is well-positioned to make a lasting impact in the EV sector and possibly see a substantial rise in share price.

Conclusion and Investor Takeaways

In conclusion, Ola Electric’s share price is influenced by a multitude of factors ranging from market trends to internal company strategies. We have seen how the dynamic landscape of the electric vehicle (EV) market, paired with Ola Electric’s aggressive growth strategies, have impacted the stock’s valuation. The EV sector is experiencing a substantial transformation, driven by both technological advancements and a global shift toward sustainable transportation solutions. Consequently, companies like Ola Electric are well-positioned to capitalize on these emerging opportunities.

For current and potential investors, understanding the strengths and potential risks associated with Ola Electric is crucial. On the one hand, Ola Electric’s continuous innovation, diversified product range, and strategic partnerships present a promising growth trajectory. The company’s ability to scale production and rapidly penetrate new markets offers substantial upside potential. Furthermore, favorable government policies and increasing consumer acceptance of electric vehicles add to the positive outlook.

Conversely, investors should also be mindful of certain risks. The EV market is highly competitive, with well-established players and new entrants continually striving for market share. Fluctuations in raw material prices, regulatory changes, and supply chain disruptions can also pose challenges. Additionally, the capital-intensive nature of the automotive industry means that efficient financial management is essential to sustaining long-term growth. Thus, while the prospects for Ola Electric appear robust, they come with inherent risks that investors need to consider carefully.

Balancing the optimistic and cautious perspectives can help investors make informed decisions regarding Ola Electric’s shares. Staying updated on the latest company developments and broader industry trends will be crucial in navigating this evolving market. By weighing the opportunities against the risks, investors can position themselves to make strategic investments that align with their financial goals and risk tolerance.